If you are interested in attending or providing IEEFP training, please contact EVO's Executive Director at: dtanguay@evo-world.org

Context

In the context of decarbonization and commitments towards a net-zero emissions transition, it is necessary to provide financing sources with solid tools to participate actively in financing energy efficiency and renewable energy projects.

Currently, energy efficiency financing is limited by a lack of knowledge, the high perception that it is risky and unattractive, and the lack of guarantees and confidence in cash flow as a source of repayment for these projects.

Who is it aimed at?

- Commercial banks interested in energy efficiency, sustainability, and emissions reduction issues.

- Financial institutions in general and other interested stakeholders in areas of sustainability, risk analysis, credit, SMEs, and business promotion in local banks.

Part I - Energy Efficiency Financing Fundamentals

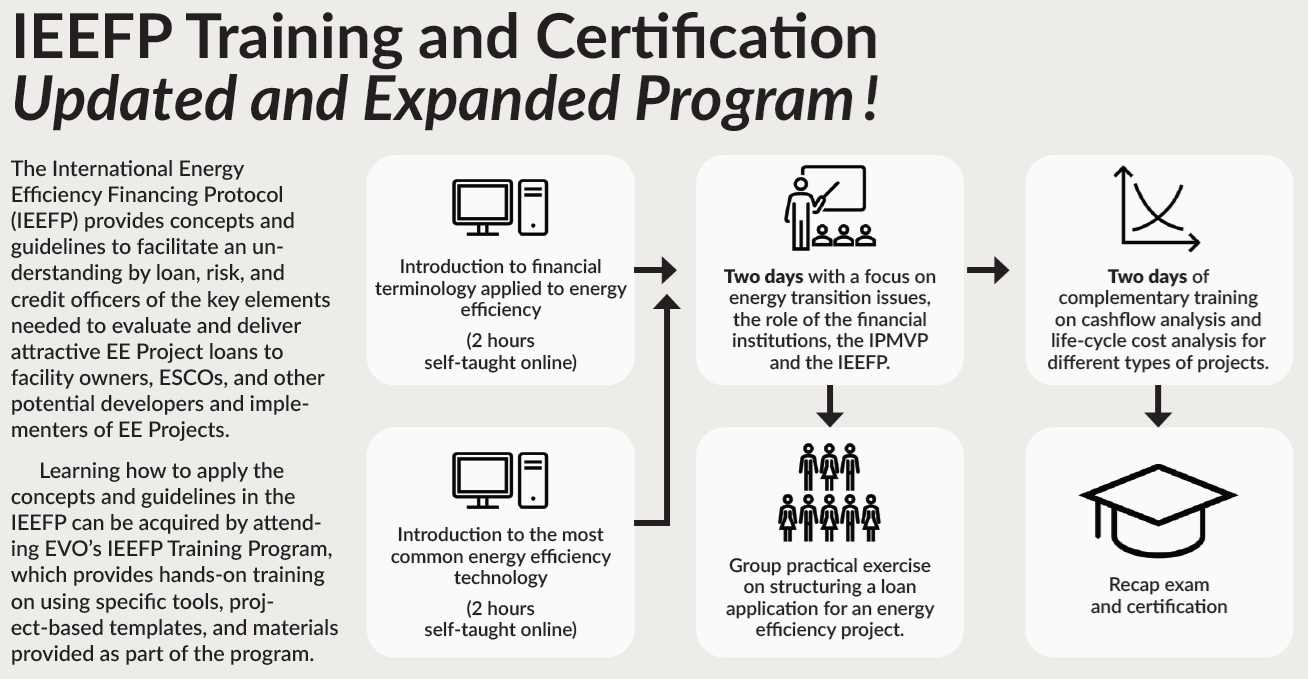

Two days with a focus on energy transition issues, the role of the financial institutions, the IPMVP and the IEEFP.

Objectives

The main objective is to provide banks with a basic understanding of the most common energy efficiency measures and associated risks so that they feel more comfortable financing energy efficiency projects and develop new financing products adapted for such projects.

What knowledge do participants gain?

- How to identify the unique risks of energy efficiency projects and the critical elements in structuring loans to energy efficiency projects on a low-risk and commercially attractive basis.

- How to rely on energy efficiency project savings for loan repayment and increased credit capacity of the energy user company.

- How to assess and mitigate the risks of energy efficiency projects that generate estimated savings.

- How to structure a project-based loan that minimizes risk and provides an attractive IRR.

- How reliable measurement and verification (M&V) using the International Performance Measurement and Verification Protocol (IPMVP) can be performed. M&V is essential to documenting and guaranteeing sustainable energy efficiency savings.

Part II - Energy Efficiency Cash Flow and Life-Cycle Cost Analysis

Two days of complementary training on cashflow analysis and life-cycle cost analysis for different types of projects.

Objectives

- Perform practical exercises to apply the theoretical knowledge obtained during the IEEFP course.

- Use tools to analyze the economic risks and benefits of energy efficiency projects with different technologies, types of buildings, and IPMVP Protocol Options.

- Conduct an in-depth analysis of the project's feasibility.

What knowledge do participants gain?

- How to analyze energy efficiency projects and the impact of different financial factors and technology types.

- How Net Present Value can vary based on changes in critical variables such as discount rates, inflation rates, and revenue and cost projections.

- Project life cycle concepts, including how to evaluate and plan for maintenance, upgrades, and possible modifications over time.

- What the electricity rate structure (and prices for other forms of energy such as natural gas) looks like and their impact on the evaluation of savings-based projects.

- Converting energy savings into GHG emissions savings.

- How to interpret uncertainty in the evaluation of savings and avoided emissions.

- Review of many case studies that address these issues.